Discretionary spending refers to optional spending. Spending for wants and not needs. As we get closer to another holiday, whether religious or market created, you must decide how to spend your income. Will you fall prey to the mountains of commercials advertising different deals, or will you keep your discretionary spending to a limit? Whatever your decision, your financial future depends on it.

Before Discretionary Spending, Wait

It is your money, you don’t have to part with it. Consider that you have worked many hours for what you have. After paying for the necessities, you may have a certain amount remaining. You may even have accumulated a certain amount of money over time. With this backdrop, why would you so easily part with your money because of an advertisement, black Friday, small business Saturday, cyber Monday or another commercial holiday? Why would you part with your hard earned money to impress people who likely do not have a second thought about your financial future?

When you are thinking of parting with your money, discretionary spending, just remember that the spending is optional. You will be spending on a want, and not a need. You do not have to buy that new TV, shoe, computer or car. Do you really need that new subscription or membership? Do you really have to take that expensive vacation? If you think you do, it is best to wait, press pause and think about that next purchase.

Give yourself at least a week before you spend your money. Think not only of the cost of the purchase, but the true cost of ownership. What other costs are associated with your purchase. Can you really afford it? Think of how many hours you would need to work to earn the amount that you would like to spend.

Think About Saving

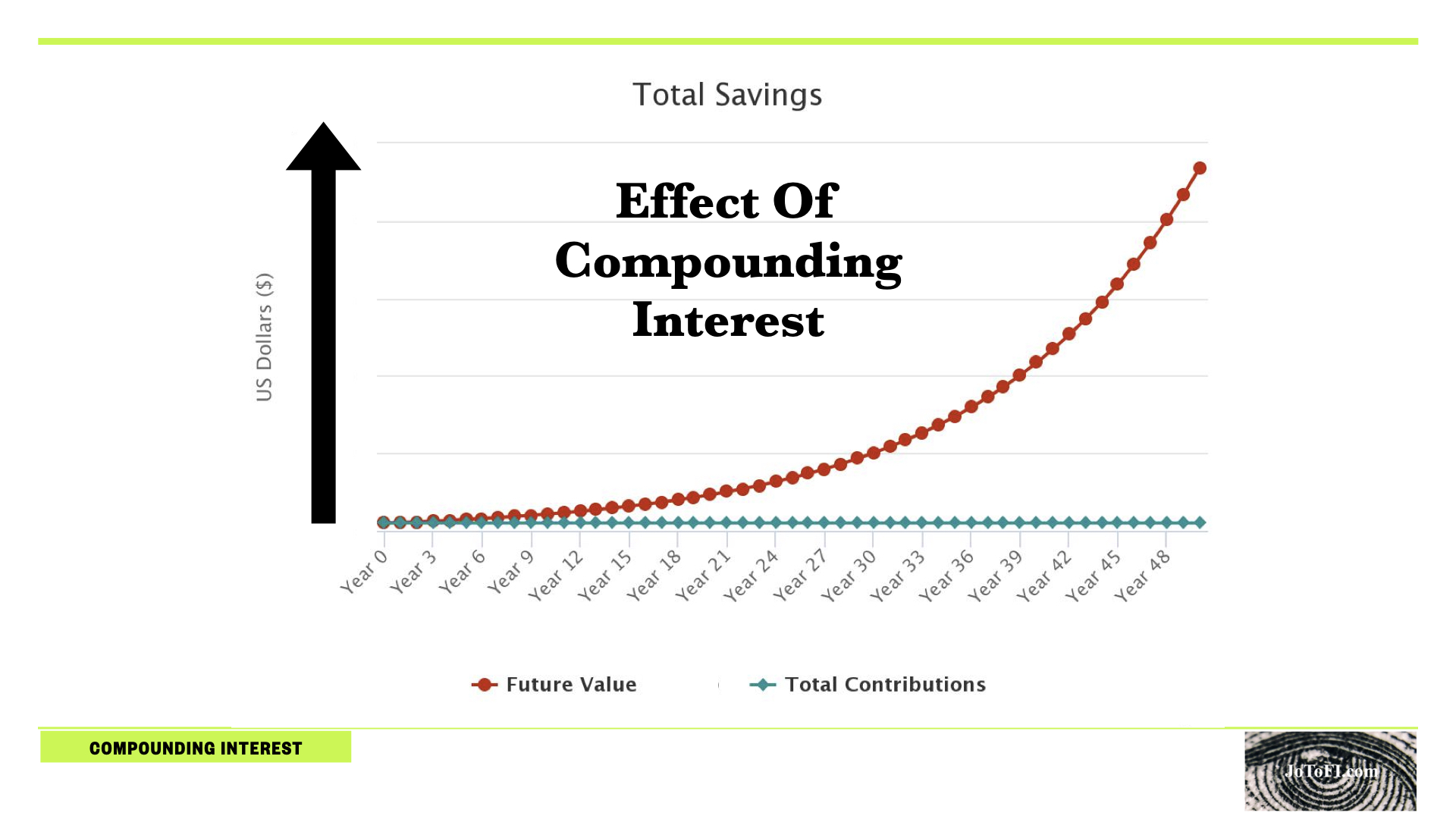

During your week of thinking about your next discretionary spending binge, think of what would happen if you saved or invested instead of spending that money. If instead of spending the money you save it in a high yield saving account or invest the money and receive standard rate of return, how much would this money mean to your financial future?

Now, is your discretionary spending worth it? Is it worth the cost of the purchase and related costs plus the additional lost of return on savings and/or investment?

Further, if you were thinking of discretionary spending to impress someone, think of where that purchase will be in two, three or four years – most likely forgotten. Do not spend to impress others. You are responsible for your financial future. Take control, set your goals and achieve them.

Your Decision Your Future

After delaying your discretionary spending to reflect, if you choose to go ahead with the discretionary spending, at the very least you have thought about it and have justified the spending. By delaying the purchase and having an understanding of the true costs associated with a purchase, you will be able to make an informed decision. Whatever your decision, let this moment of financial reflection change your money mindset for the future.

Conclusion

Discretionary spending refers to optional spending. Spending for wants and not needs. As we get closer to another holiday, whether religious or market created, you must decide how to spend your income. Will you fall prey to the mountains of commercials advertising different deals, or will you keep your discretionary spending to a limit? Whatever your decision, your financial future depends on it.

Follow me on Twitter @JoToFI_com

Follow me on Instagram @JoToFI_com