On the journey to financial independence, each milestone is fuel for the next. One of the greatest initial milestone is that of accumulating funds over time. Once you have accumulated your first $50,000, it is time to think about saving the next $50,000 and beyond. The biggest step on your journey to financial independence is the step you take today. Take the next step.

The Plan – Saving The Next $50,000

Just like enacting any plan that requires a change in habits or direct action, implementation of your plan to financial independence can be difficult. If you choose to save by cutting back on eating out, this will no doubt affect your social life. If you decide to work a side hustle, this will take time from other activities. To journey to financial independence, you will make sacrifices.

However, by the time you begin saving the next $50,000, you have already made changes and can now use the momentum that you have build up saving your first $50,000 and further optimize your strategy. Because of the habits formed saving your first $50,000, saving the next $50,000 will be easier to achieve.

Your Emergency Fund

By the time you are on the path to saving the next $50,000, based on your lifestyle, your emergency fund may now be fully funded or very close to being fully funded. This is a huge step and should provide comfort for you and your family. Saving 3 months, 6 months, or one year of expenses in your emergency fund is a huge step and you should feel very proud of yourself for achieving this milestone. Further, you should be motivated by the fact that you can do it. You can do this. The steps taken to financial independence is paying off.

Once you have achieved a fully funded emergency fund, do not stop saving. Continue the same habits. Do your homework, research and optimize your plan. Achieving financial independence takes time and consistency.

Once you have fund your emergency fund, instead of putting money into an emergency fund, you are now able to contribute that money to another area of your plan. Will you be contributing more to retirement, paying down debt if you still have debt, or invest?

Contributing To Retirement

Once you begin to save, you should attend to your retirement fund, especially if your employer is providing a match. No matter how little you may contribute, contribute to your retirement.

Now that you are saving the next $50,000, begin to increase your retirement contributions, especially if you have already paid down debt. In the year 2020, your contribution limits for a 401k is $19,500 (catch-up contribution limit for employees aged 50 and over is $6,500). The contribution limits for an IRA is $6,000 ($7,000 if you’re age 50 or older). As such, you are able to put away $25,500 ($33,000 if you are aged 50 or older).

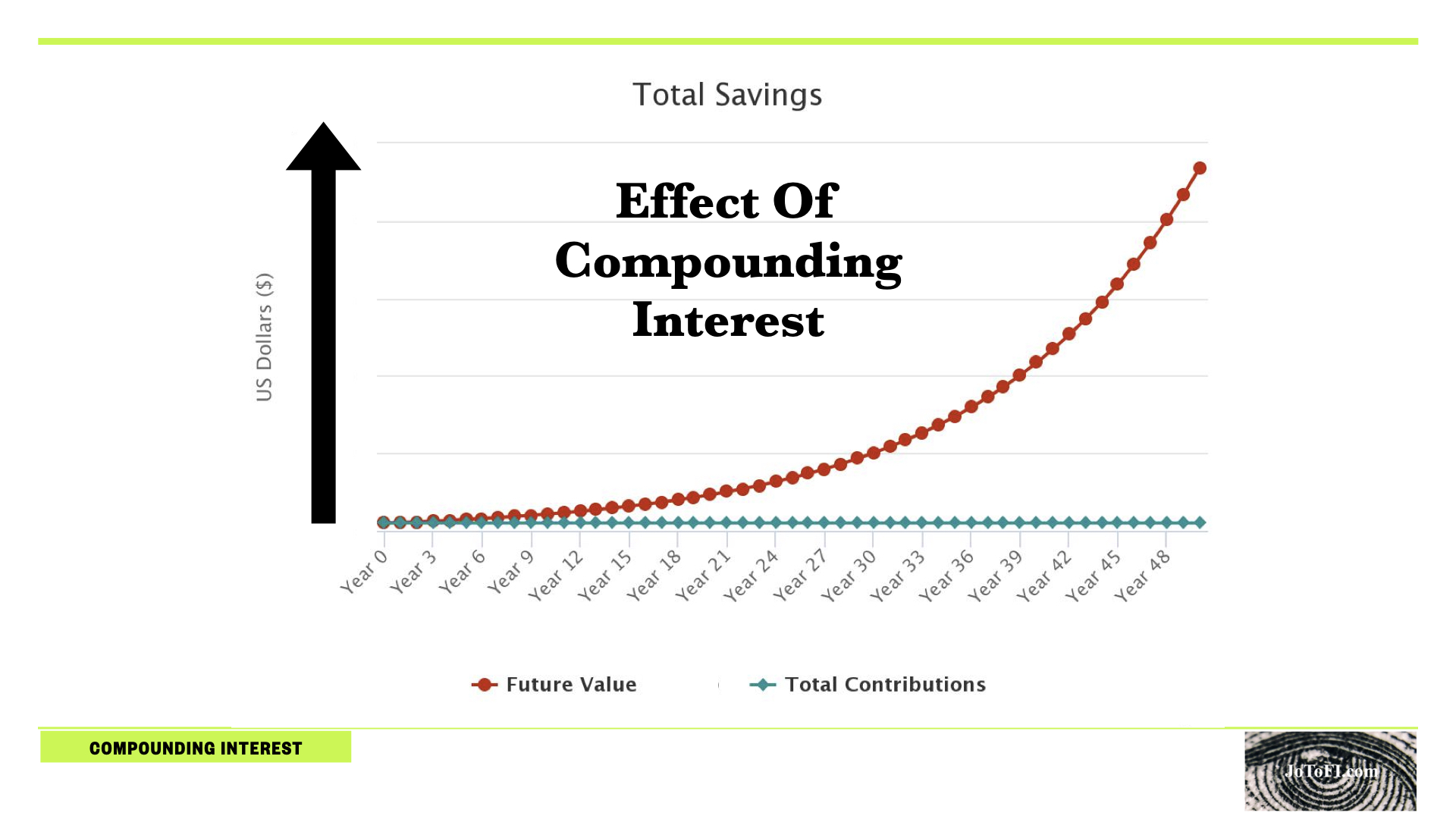

On the path to financial independence, by consistently contributing to tax advantaged retirement accounts, it is possible to join the 401k millionaire club.

Paying Down Debt

Once you begin to save, you will also need to attend to debts. You will definitely want to keep your accounts current by paying at least the minimum. Once your emergency fund is fully funded, it will be time to pay more than your minimum.

Remember, the best way to obtain a 16-18% return (the average interest charge on a credit card), is to pay off your credit card debt.

It is advisable to pay down debts having the highest interest rate. This will lower your interest payments as you pay down the debt. Another approach is to pay down the smallest debt first, such that you have a snow ball effect of paying the least balance to highest balance. The method used here is up to you. Which method will motivate you to pay down your debts faster?

Paying down debt in the early stages of your journey to financial independence typically provides the greatest early return. Paying down debt yields exponential benefits as it frees up funds for contributing to retirement and investment accounts such that you are able to take advantage of the power of compounding.

Ride The Wave – Saving The Next $50,000

As you are able to fund your emergency fund, pay off your debts, and contribute to your retirement, you will begin to have more funds available to further your race to financial independence. The funds that went to your emergency fund can be used to pay down debt, contribute to retirement fund, and/or invest.

Do not feel the need to “reward your self.” You do not want to fall into the trap of lifestyle creep/lifestyle inflation. You do not want to raise your standard to living as you earn more/have more disposable income. There are lots of folks who save the same amount when making $100,000 as they did when they were making $50,00. If you follow this path, this will be a detriment to your ultimate goal of financial independence.

As your income/disposable income increases, the amount you save/invest should be increase as well. Live below your means, and journey to financial independence.

Conclusion

On the journey to financial independence, each milestone is fuel for the next. One of the greatest initial milestone is that of accumulating funds over time. Once you have accumulated your first $50,000, it is time to think about saving the next $50,000 and beyond. The biggest step on your journey to financial independence is the step you take today. Take the next step.

Follow me on Twitter @JoToFI_com

Follow me on Instagram @JoToFI_com

Great article.